New Delhi, Sept. 16 -- 1.0. Introduction - The Governance Paradox

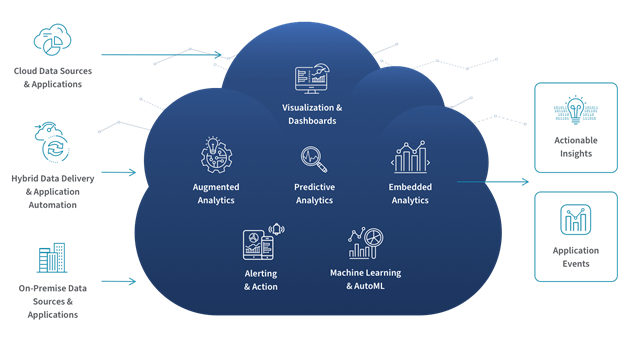

In today's data-driven economy, enterprises are racing to harness the full power of cloud-based analytics. The promise is irresistible: near real-time insights, predictive models at scale, and agile decision-making that can pivot entire business strategies overnight. Retailers analyze millions of transactions daily to tailor promotions, healthcare providers mine patient records to deliver precision care, and financial institutions scan streams of transactions to flag fraud in milliseconds. Cloud-native platforms make this level of agility possible, enabling unprecedented scalability and speed. Yet with every leap forward in analytics capability, the complexity of governance and compliance grows. The very innovations that accelerate insight - distributed cloud storage, federated data access, AI-driven analytics, also expand the attack surface for risk. Organizations find themselves caught in a paradox: the stronger their analytics capabilities, the more fragile their compliance posture becomes.

1.1. The Expanding Web of Regulations

The governance challenge is not theoretical. Around the globe, a dense web of regulations demands accountability, transparency, and security in how organizations manage data:

* GDPR (General Data Protection Regulation) in Europe sets strict standards for personal data protection, including the right to erasure ("right to be forgotten") and requirements for consent management. * CCPA (California Consumer Privacy Act) and its successor CPRA extend similar protections in the U.S., giving consumers unprecedented control over their data. * HIPAA (Health Insurance Portability and Accountability Act) governs Protected Health Information (PHI) in healthcare, with steep penalties for breaches. * SOX (Sarbanes-Oxley Act) requires financial firms to maintain auditable records, strengthening the integrity of corporate disclosures. * Emerging frameworks such as the EU AI Act add new dimensions, holding enterprises accountable for algorithmic transparency, fairness, and oversight.

These mandates are non-negotiable. Fines under GDPR alone can reach 4% of annual global revenue, a potentially existential threat for large enterprises. And beyond fines, reputational damage from a compliance failure can be catastrophic, eroding customer trust faster than it can be rebuilt.

1.2. The Business Demand for Speed

Complicating matters further is the relentless demand from business leaders for faster, deeper insights. CMOs want real-time customer intelligence to optimize campaigns. CFOs demand daily dashboards with up-to-the-minute forecasts. Operations teams expect predictive alerts that anticipate supply chain disruptions before they happen. Traditional governance models, with their reliance on manual audits, policy reviews, and human oversight, cannot keep up with this tempo. They operate as bottlenecks, checkpoints that slow down the analytics lifecycle and frustrate innovation. In practice, this leads to one of two outcomes: either analytics delivery is delayed, or compliance corners are cut. Both paths are unsustainable.

1.3. The Governance Paradox Defined

This tension between regulatory rigor and business agility is the governance paradox of the modern enterprise. On one side lies the imperative to comply with an ever-expanding universe of laws and standards. On the other lies the pressure to deliver insights at the speed of digital competition. For many organizations, this paradox feels like a zero-sum game: move fast and risk compliance exposure, or comply rigorously and sacrifice agility. But this framing is outdated. The real challenge, and opportunity, is to design systems where compliance is not a constraint but a catalyst for innovation.

1.4. Compliance-by-Design: A New Mindset

The solution is a shift in mindset: compliance-by-design. Rather than bolting on governance as a series of audits or retroactive reviews, compliance-by-design embeds regulatory and governance principles directly into the architecture of cloud analytics platforms. This means automation replaces manual checks, policies are encoded as rules enforced continuously, and compliance becomes a living fabric woven through every stage of the data lifecycle. In this paradigm, compliance does not slow innovation, it enables it. By ensuring data is trustworthy, secure, and governed from the outset, enterprises unlock the confidence to scale analytics faster, adopt AI more responsibly, and innovate without fear of regulatory backlash.

1.5. Why Now?

The urgency of this transformation cannot be overstated. As enterprises expand into multi-cloud and hybrid environments, federate data across geographies, and embed AI into critical decision systems, the risks of non-compliance multiply. Static, audit-driven approaches are simply too brittle to manage this complexity. Compliance-by-design, by contrast, offers resilience. It transforms compliance from a reactive burden into a strategic enabler of agility and trust. It closes the governance paradox by making compliance invisible until needed, and unshakable when tested.

2.0. What is Compliance-by-Design?

At its core, compliance-by-design is the recognition that compliance cannot be treated as an afterthought. In the traditional model, organizations-built data platforms first and layered governance on top later, typically during audits or in response to incidents. This reactive posture left gaps, created costly manual workarounds, and turned compliance into a roadblock rather than a safeguard. Compliance-by-design flips this paradigm. It embeds governance and regulatory obligations into the architecture itself, ensuring that compliance is not bolted on but continuously enforced throughout the data lifecycle. Every stage, from ingestion to storage to analysis to deletion - carries governance controls by default. In this model, compliance becomes proactive, continuous, and invisible until it's needed.

2.1. From Audits to Architecture

The traditional view of compliance is episodic: periodic audits, static checklists, and heavy human oversight. Compliance officers act like inspectors, coming in after the fact to identify gaps and issue recommendations. While effective in the short term, this approach is fundamentally misaligned with modern cloud ecosystems, which are:

* Dynamic: Data schemas and sources change constantly as products evolve. * Distributed: Multi-cloud and hybrid environments multiply dependencies. * High-velocity: Data moves in real time, leaving little margin for manual checks.

Compliance-by-design addresses these realities by embedding automated, continuous controls within workflows. It shifts compliance from being an external checkpoint to becoming part of the system's DNA.

2.2. A Cultural Shift: From Policing to Enabling

Beyond architecture, compliance-by-design requires a cultural change. In many enterprises, compliance is viewed as "the department of no" - a group tasked with slowing down initiatives in the name of caution. This adversarial framing creates tension between compliance officers and business leaders eager to move fast. Compliance-by-design reframes the role of governance professionals. Instead of policing activity, they become enablers of innovation, building frameworks that allow business units to experiment confidently within safe boundaries. Policies are not obstacles but guardrails, invisible when not needed, but unshakable when tested.

2.3. Architectural Principles of Compliance-by-Design

In practice, embedding compliance into cloud analytics platforms means adopting several foundational principles:

1. Automation-first: Compliance cannot rely on manual reviews. Rules must be codified as machine-enforceable policies applied automatically across the data estate. 2. Seamless integration: Governance must flow with analytics, not against it. Compliance checks are embedded into ingestion, transformation, and reporting pipelines, ensuring no additional friction. 3. Continuous enforcement: Instead of one-time audits, controls are monitored and applied in real time, adapting as environments change. 4. Sector adaptability: Compliance frameworks must flex to accommodate industry-specific regulations - HIPAA for healthcare, SOX for finance, GDPR/CCPA for consumer data. 5. Scalable by design: Multi-cloud, hybrid, and global operations require compliance systems that can scale horizontally, not break under complexity.

2.4. Why This Matters for Cloud Analytics

Cloud platforms have amplified both the promise and the peril of data. On one hand, cloud-native tools democratize analytics, allowing teams to experiment and innovate faster. On the other hand, without embedded governance, the same agility can spiral into uncontrolled risk: sensitive data scattered across regions, misconfigured permissions exposing millions of records, or retention lapses leading to regulatory breaches.

Compliance-by-design addresses this tension by making governance invisible until needed. Data scientists, engineers, and analysts can innovate freely, knowing that controls for discovery, classification, access, retention, and encryption are operating in the background. When auditors, regulators, or executives require proof, granular logs and lineage trails are instantly available.

2.5. The Analogy: From Seatbelts to Data Governance

Think of compliance-by-design as the seatbelt of cloud analytics. Drivers don't think about buckling up at every turn; the system is there, unobtrusive, protecting them when needed. Similarly, compliance-by-design provides quiet, continuous protection, invisible during everyday operation, unshakable during audits or incidents. This analogy underscores the mindset shift: compliance should not be an external inconvenience but an integral safety mechanism that enables enterprises to drive faster without sacrificing trust.

3.0. Key Principles of Embedding Governance

Compliance-by-design is not an abstract philosophy; it is grounded in practical principles that can be embedded directly into cloud-based analytics platforms. These principles ensure that governance is not a bottleneck but an enabler - providing continuous safeguards without slowing innovation. Let's examine the five pillars of compliance-by-design in detail.

3.1. Automated Data Discovery and Classification: The foundation of governance is simple: you cannot protect what you do not know you have. In sprawling cloud environments, data is scattered across object stores, warehouses, streaming platforms, and SaaS applications. Manual inventories are impossible at scale. Automated discovery and classification tools are essential. Cloud-native services like AWS Lake Formation, Azure Purview, and Google Cloud Data Loss Prevention (DLP) scan environments continuously, tagging sensitive assets such as:

* Healthcare: Protected Health Information (PHI) subject to HIPAA. * Finance: Audit trails and Sarbanes-Oxley (SOX) records. * Retail: Customer identifiers regulated by GDPR and CCPA

By automating this process, enterprises gain a living map of their data landscape. This supports not only compliance but also operational agility: teams can quickly locate relevant datasets, understand sensitivity levels, and design safeguards tailored to regulatory requirements.

3.2. Policy-Driven Access Control: Once sensitive data is identified, the next question is: who can access it, and under what conditions? Traditional access control methods often rely on static roles or manual approvals. These approaches invite both risk (over-permissioned accounts) and inefficiency (bottlenecks in approvals). Compliance-by-design emphasizes policy-driven, automated enforcement:

* Role-Based Access Control (RBAC) ensures that only specific job functions can access regulated data. * Attribute-Based Access Control (ABAC) goes further, applying dynamic conditions (e.g., location, device type, time of day) to enforce contextual restrictions. * Zero-trust models assume no implicit trust - every request is authenticated, authorized, and logged.

Compared to traditional governance catalogs like Collibra that rely heavily on human oversight, compliance-by-design prioritizes seamless automation. Policies are centrally defined, applied uniformly, and updated continuously. This reduces shadow IT risks, prevents privilege creep, and ensures consistent compliance.

3.3. Auditability and Traceability: Regulators, auditors, and executives alike demand a clear answer to the question: "Can you prove what happened?" Without traceability, even compliant organizations struggle to demonstrate compliance. Compliance-by-design embeds granular audit logs and lineage tracking into every workflow. Every query, transformation, and data transfer is captured in immutable logs. Lineage tools can reconstruct exactly how a dataset was produced - from raw ingestion to analytics output. This transparency provides two benefits:

* Regulatory assurance: Enterprises can quickly generate reports to satisfy auditors. For example, proving GDPR compliance requires demonstrating not just that data was deleted but that the deletion propagated across all downstream systems. * Internal trust: Analysts and executives gain confidence in dashboards when they can trace metrics back to source systems.

Auditability is not a burden when it is built in by default. In compliance-by-design, it is a natural byproduct of daily operations.

3.4. Data Minimization and Retention: One of the core tenets of global regulations is data minimization - the principle that organizations should collect and retain only the data necessary for their business purposes. Yet in practice, enterprises often hoard data indefinitely "just in case." This not only inflates storage costs but also increases compliance risk. Compliance-by-design solves this through automated retention policies. Rules enforce retention windows aligned with sectoral obligations:

* Financial records retained for seven years under SOX. * Consumer data deleted on request under GDPR/CCPA. * Healthcare data retention rules tailored to HIPAA requirements.

These policies ensure compliance without relying on manual clean-up campaigns. In addition, minimization reduces the blast radius of breaches. If sensitive data is not retained unnecessarily, it cannot be exposed.

3.5. Encryption and Data Protection by Default: Finally, compliance-by-design requires that data protection be non-negotiable and automatic. Encryption at rest, in transit, and in some cases in use (through confidential computing techniques) is table stakes. Modern cloud platforms make this straightforward:

* AWS KMS, Azure Key Vault, and Google Cloud KMS provide centralized key management. * Tokenization and pseudonymization techniques protect sensitive identifiers while maintaining analytic utility. * Confidential computing enclaves enable sensitive workloads to run on encrypted data without exposing raw content.

The critical point is that security must be embedded, not optional. When protection is enforced by design, enterprises avoid the pitfalls of misconfigured settings or forgotten encryption keys.

3.6. Bringing the Principles Together: Individually, each of these principles strengthens compliance. Together, they create a governance fabric that is proactive, continuous, and invisible until tested.

* Automated discovery ensures organizations know their assets. * Policy-driven access limits exposure. * Auditability ensures transparency. * Minimization reduces risk. * Encryption guarantees protection.

This holistic model contrasts sharply with traditional governance, which often relies on siloed tools and episodic enforcement. Compliance-by-design integrates these principles into the flow of analytics itself, ensuring that governance moves at the speed of cloud innovation.

4.0. The Value Proposition

For years, compliance has carried the reputation of being a cost center, a necessary overhead to satisfy regulators, avoid penalties, and protect brand reputation. Business leaders often framed governance as a burden to be minimized, not a source of value. Compliance-by-design overturns this perception. By embedding compliance into the very fabric of cloud-based analytics, organizations discover that governance is not just about reducing risk, it is about unlocking measurable financial, cultural, and competitive benefits.

* $4.45M - the global average cost of a data breach in 2023 (IBM Security) * 30-50% time savings from automated policy enforcement compared to manual compliance checks * Tens of millions in potential regulatory fines avoided (e.g., GDPR penalties up to 4% of annual revenue) By shifting from manual audits to automated, embedded compliance, enterprises reduce financial exposure while accelerating analytics delivery.

5.0. Why This Model Is Different

Most organizations already have some form of governance in place. Policies exist, audits are conducted, and tools like governance catalogs or manual compliance trackers provide oversight. But despite these efforts, breaches still happen, fines are levied, and innovation is slowed. Why? Because traditional governance operates as a checkpoint, not a fabric.

5.1. Traditional Governance: Episodic and Reactive

In the traditional model, compliance is treated as an episodic exercise:

* Periodic audits assess whether controls were followed. * Manual reviews check for data access violations. * Spreadsheets and catalogs track lineage or policy adherence.

This approach may satisfy minimum regulatory requirements, but it suffers from fundamental flaws:

1. Disconnected from real-time operations - Traditional governance reviews what happened weeks or months ago. In fast-moving cloud environments, this is already too late. 2. Manual and error-prone - Human oversight dominates, making compliance expensive, slow, and prone to mistakes. 3. Perceived as a barrier - Business units see governance as a "slow lane," delaying initiatives and creating incentives for workarounds. 4. Limited scalability - Manual models break down in multi-cloud and global contexts, where thousands of pipelines and petabytes of data must be monitored continuously.

In short, traditional governance is reactive, brittle, and burdensome.

5.2. Compliance-by-Design: Continuous and Embedded

Compliance-by-design rejects this checkpoint mentality. Instead, it operates as a living fabric woven throughout the analytics lifecycle. The key differences include:

* Automation-first: Policies are encoded as enforceable rules, not guidelines requiring human validation. * Real-time enforcement: Compliance checks occur during data ingestion, transformation, and usage, not weeks later in audits. * Invisible guardrails: Controls are seamless, allowing analysts and engineers to innovate without disruption. * Scalable by default: Automation and cloud-native tools allow governance to scale across multi-cloud and hybrid environments without linear cost growth.

The contrast is stark. Traditional governance asks, "Did you comply?" after the fact. Compliance-by-design ensures, "You cannot not comply" in the first place.

5.3. A Parallel with DevSecOps

The evolution mirrors what happened in software development with DevSecOps. In the past, security was bolted on at the end of the development cycle, creating bottlenecks and vulnerabilities. DevSecOps shifted security "left",embedding it into every stage of the development pipeline. Today, secure coding practices, automated vulnerability scans, and policy-as-code are standard. Compliance-by-design is the data governance equivalent of DevSecOps:

* Governance is shifted left into ingestion and transformation stages. * Policy enforcement is automated as code. * Monitoring and auditability are continuous, not episodic.

Just as DevSecOps enabled faster, safer software delivery, compliance-by-design enables faster, safer analytics delivery.

5.4. Why This Matters in the Cloud Era: The difference is not academic; it is existential in the cloud era. Cloud platforms amplify both the velocity and risk of data operations. Pipelines refresh in real time, spanning geographies, clouds, and SaaS ecosystems. Manual compliance models simply cannot keep pace. Compliance-by-design is built for this environment:

* Multi-cloud adaptability: Policies apply consistently whether data resides in AWS, Azure, GCP, or hybrid stores. * Sector specificity: Rules adapt to HIPAA, GDPR, SOX, and CCPA simultaneously, depending on the dataset. * Continuous resilience: Controls are tested and updated continuously, just as analytics pipelines evolve.

Traditional governance cracks under this complexity. Compliance-by-design thrives in it.

5.5. Cultural Differentiation

There is also a cultural distinction. Traditional governance casts compliance officers as auditors and enforcers, often creating tension with business leaders. Compliance-by-design reframes them as strategic enablers, building trust by allowing teams to innovate safely. This shift is profound. When compliance is embedded seamlessly, organizations no longer see governance as the "department of no." Instead, compliance becomes an invisible ally, protecting the enterprise while enabling agility.

6.0. Industry Case Studies

Compliance-by-design is not just a theoretical framework; it is already delivering measurable results across industries. Each sector faces unique regulatory pressures and operational challenges, but the same embedded governance principles - automated discovery, policy-driven access, auditability, retention, and encryption - consistently translate into resilience, efficiency, and trust.

6.1. Healthcare: Automating HIPAA Compliance: Few industries face higher stakes than healthcare. Patient trust and safety depend on the integrity of protected health information (PHI). Traditionally, HIPAA compliance required costly manual oversight: privacy officers reviewing access logs, data retention tracked through spreadsheets, and audits conducted episodically. By adopting compliance-by-design, healthcare organizations transform this process:

* Automated PHI detection classifies sensitive records at ingestion. * Dynamic retention policies delete or anonymize data when it exceeds regulatory windows. * Encryption by default ensures that PHI is protected at rest, in transit, and in use.

The results are twofold. First, patient trust improves when providers can demonstrate airtight safeguards. Second, compliance teams move from reactive audits to continuous assurance, reducing overhead. A leading U.S. hospital system reported 30% faster audit readiness and significantly fewer compliance incidents after automating HIPAA protections.

6.2. Finance: Turning SOX into a Byproduct of Operations: Financial institutions must comply with Sarbanes-Oxley (SOX), which mandates rigorous audit trails of financial data. Historically, this meant manual reconciliations and expensive compliance teams ensuring every record could be traced. The process was labor-intensive, error-prone, and often viewed as a tax on operations. Compliance-by-design changes the equation. Lineage tools embedded in cloud data platforms automatically generate immutable audit trails as part of daily workflows. Access policies ensure that only authorized roles - auditors, controllers, or regulators - can query sensitive records.

For one global bank, this meant that instead of scrambling for quarterly SOX audits, evidence was always ready, updated in real time. The outcome: millions saved in audit preparation costs and renewed regulator confidence. By making compliance seamless, the bank turned governance into a strength rather than a burden.

6.3. Retail & Consumer: GDPR and CCPA at Scale: Retailers and consumer platforms face intense scrutiny under GDPR and CCPA, particularly around the "right to be forgotten." When customers request deletion, companies must not only remove data from central warehouses but also propagate that change across every downstream application, cache, and backup. Traditional approaches struggled with this requirement, often taking weeks to complete deletion requests manually. Compliance-by-design solves the problem by embedding retention and deletion logic directly into pipelines. Requests are executed automatically at scale, ensuring global compliance within hours rather than weeks.

For a European e-commerce giant, this shift reduced regulatory exposure dramatically. Instead of fearing GDPR fines of up to 4% of global revenue, the company could demonstrate real-time compliance. Customer sentiment also improved: surveys showed that consumers were 20% more likely to trust and recommend the brand once deletion requests were consistently honored on time.

6.4. Government & Public Sector: Continuous Monitoring: Government agencies and public sector organizations face a dual challenge: strict compliance requirements and limited budgets. Frameworks like FedRAMP mandate continuous monitoring of cloud environments, but manual enforcement has historically been resource-intensive.

By embedding compliance-by-design, agencies can achieve FedRAMP alignment through:

* Automated classification of sensitive citizen data. * Centralized access policies for contractors, reducing insider risk. * Continuous audit logging, providing regulators with on-demand evidence.

One U.S. state agency piloted compliance-by-design for its unemployment benefits platform. The result: audit preparation time dropped by 40%, while staff could reallocate effort from compliance firefighting to service improvement. At a time when public trust in government data handling is fragile, these improvements were invaluable.

6.5. The Common Thread: From Burden to Enabler: While the regulatory acronyms differ - HIPAA, SOX, GDPR, CCPA, FedRAMP - the story is the same. Traditional compliance approaches created bottlenecks and drained resources. Compliance-by-design flips the narrative:

* Healthcare builds patient trust. * Finance reduces audit costs. * Retail avoids massive fines while strengthening customer loyalty. * Government increases efficiency and transparency.

Across sectors, compliance becomes an enabler of speed, trust, and resilience, not a drag on innovation.

7.0. Future Vision - AI-Driven Compliance

Compliance-by-design is already transforming governance, but the next wave of innovation will take it even further. Advances in generative AI, autonomous agents, and intelligent automation are poised to elevate compliance from continuous enforcement to self-adaptive orchestration. In this vision, compliance not only keeps pace with regulations but also anticipates and adapts to them - making governance both proactive and predictive.

7.1. Generative AI as a Compliance Copilot

Generative AI is already proving its value in assisting with natural language queries and automated content creation. In compliance, its role will be as a copilot for governance officers and engineers.

* Policy drafting in plain language: Compliance officers will be able to describe obligations like "Financial records must be retained for seven years" in natural language. AI copilots will translate this into machine-enforceable retention rules across platforms. * Dynamic rule updates: As regulations evolve, copilots can scan legal texts, identify changes, and recommend policy updates - reducing the lag between regulation and enforcement. * Audit preparation: Generative AI can generate compliance reports and risk summaries automatically, freeing teams from weeks of manual document compilation.

This will democratize compliance, making it accessible to both legal experts and technical teams without requiring them to manually translate law into code.

7.2. Agentic AI for Autonomous Enforcement

Where copilots assist humans, agentic AI goes further by acting autonomously. Imagine AI agents continuously monitoring access logs, pipeline behaviors, and usage anomalies - intervening in real time when risks are detected.

* Access anomaly detection: Agents can flag unusual usage patterns, such as a marketing analyst suddenly querying payroll data, and automatically quarantine the request until reviewed. * Automated remediation: Agents can revoke misconfigured permissions, apply encryption retroactively, or trigger retention workflows without human involvement. * Collaborative enforcement: Multiple agents can coordinate: one scanning for schema violations, another validating retention rules, and another ensuring encryption standards - creating a distributed, intelligent compliance workforce.

In effect, agentic AI turns compliance into a self-healing ecosystem, where anomalies are not just detected but resolved in near real time.

7.3. Convergence with Responsible AI

Regulators and enterprises alike are increasingly focused on responsible AI - ensuring that algorithms are explainable, fair, and auditable. Compliance-by-design will converge with these requirements, extending governance beyond data pipelines to the AI models they fuel.

* Bias monitoring: Compliance frameworks will detect biased inputs before they reach models, protecting enterprises from reputational and regulatory damage. * Explainable AI integration: Every compliance action - from data deletion to access revocation - will include interpretable justifications, satisfying the explainability clauses of the EU AI Act and similar laws. * End-to-end accountability: Lineage will extend not just from source data to dashboards, but from raw data to AI predictions, ensuring enterprises can defend decisions made by automated systems.

This convergence positions compliance not just as a legal obligation but as the foundation of trustworthy AI adoption.

7.4. Compliance-as-Code: The Next Evolution

Compliance-by-design today emphasizes automation, but tomorrow it will evolve into compliance-as-code - a model where policies are versioned, tested, and deployed just like software. This will allow enterprises to:

* Deploy governance updates globally with a single push. * Test compliance policies in staging environments before applying them to production. * Roll back policies safely if conflicts are detected.

This will mirror the rise of infrastructure-as-code, which revolutionized IT by making environments programmable, consistent, and auditable. Compliance-as-code will bring the same discipline to governance.

7.5. A Vision of the Future Enterprise

Picture an enterprise in 2030:

* Compliance officers articulate policies in natural language. * AI copilots translate them into enforceable rules across multi-cloud platforms. * Agentic AI agents patrol the data ecosystem continuously, flagging and fixing anomalies autonomously. * Quantum-inspired optimizers ensure global compliance systems scale efficiently. * Regulators request audit evidence, and the enterprise produces a complete, immutable compliance history in seconds.

In such an environment, compliance is no longer a drag on innovation. It becomes a trusted foundation for growth, giving enterprises the confidence to scale AI, expand globally, and innovate faster than competitors still wrestling with manual audits.

8.0. Conclusion

Enterprises today face a profound paradox: the more powerful their analytics platforms become, the more fragile their compliance posture appears. Traditional, audit-driven governance can no longer keep pace with the scale, speed, and complexity of cloud-based analytics and AI. Organizations that cling to these models' risk not only regulatory exposure but also eroded trust, stalled innovation, and lost competitiveness. Compliance-by-design offers a way out of this paradox. By embedding discovery, policy-driven access, auditability, retention, and encryption directly into cloud-native architectures, enterprises transform compliance from a burden into a catalyst. Governance becomes continuous, automated, and invisible until tested. The result is a system where data is trustworthy by default, innovation is accelerated, and regulatory obligations are met seamlessly.

The implications are transformative. Case studies from healthcare, finance, retail, and government show how compliance-by-design improves patient trust, reduces audit costs, avoids multimillion-dollar fines, and increases public transparency. Beyond these sectoral wins, the model sets a new benchmark for industry-wide resilience and global digital trust. As standards, certifications, and digital frameworks emerge, early adopters will define what responsible innovation looks like in the AI economy.

For leaders, the lesson is clear: compliance-by-design is not a narrow technical upgrade. It is a strategic shift in culture and leadership. CIOs, CISOs, and CDOs who embrace it elevate their roles from enforcers of rules to enablers of growth. Boards move from asking "Are we compliant?" to asking "How can we leverage our compliance strength to innovate faster?" Talent is attracted and retained by environments where governance reduces toil rather than creates it.

Looking ahead, the integration of generative AI, agentic AI, and compliance-as-code will push this model even further, creating self-healing compliance ecosystems that adapt continuously to evolving risks and regulations. The organizations that prepare for this future today will enjoy a durable competitive advantage tomorrow.

The conclusion is simple but urgent: compliance-by-design is not optional. It is the new baseline for enterprises that want to thrive in the AI economy. Those who adopt it will innovate responsibly, earn durable trust, and set the standards others will follow. Those who don't will find themselves slowed by audits, exposed to fines, and left behind in a marketplace that rewards resilience and trust above all.

The future of data governance has already arrived. The only question is whether you will lead it or be forced to catch up.

No Techcircle journalist was involved in the creation/production of this content.

Published by HT Digital Content Services with permission from TechCircle.