New Delhi, Nov. 20 -- Private equity firm TPG has committed to invest as much as $1 billion in an AI data centre joint venture with Tata Consultancy Services Ltd, India's biggest software services exporter.

The AI data center business housed under TCS' wholly owned subsidiary HyperVault AI Data Center Limited will be partly funded through equity capital from TCS and TPG Terabyte Bidco Pte Ltd. The remaining will be raised through the issue of multiple tranches of compulsorily convertible preference shares.

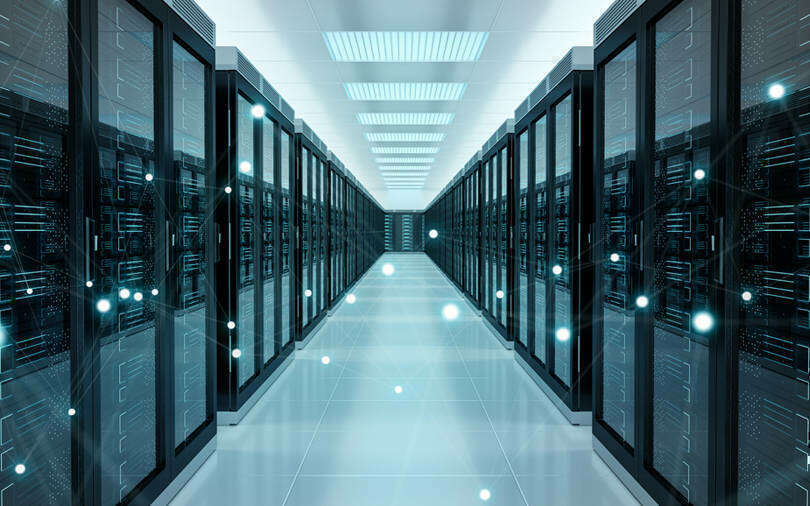

HyperVault's planned gigawatt-scale AI-ready infrastructure will get a boost from this investment, which aligns with TCS' strategy to develop data centers exceeding 1 GW capacity in the coming years.

The partners plan to invest up to Rs 18,000 crore (around $2.03 billion) over the next few years, with TPG contributing up to Rs 8,820 crore for up to 49% stake.

According to an exchange filing from TCS, HyperVault will be exclusively dealing with the business of TCS subject to certain exceptions, and the investment will have a lock in period of three years during which neither parties will be able to transfer securities except to affiliates.

TCS will have the right to appoint the majority of the directors on the board of HyperVault, and TPG Terabyte will have the right to appoint two directors "subject to customary fall away thresholds".

This is the third business association between the Tata Group companies and TPG. In 2021, TPG invested Rs 7,500 crore ($1 billion) in Tata Motors' EV arm for an 11-15% stake. It later acquired a 9% stake in Tata Technologies for Rs 1,467 crore ahead of its IPO, though it has since pared holdings through open-market sales.

In the latest deal, TPG's investment will come via its Rise Climate fund and Global South Initiative (GSI), launched with ALTERRA, alongside its Asia Real Estate arm. According to VCCEdge, TPG Rise Climate is a 2021 vintage PE fund that provides growth-stage capital to entities operating in clean energy and greening industrials among others. GSI, housed under TPG Rise Climate, seeks to attract institutional capital to private-equity investments in high-growth climate opportunities.

TCS was advised by AZB & Partners and Deloitte Touche Tohmatsu India LLP, while TPG was advised by Cyril Amarchand Mangaldas, Latham & Watkins LLP, and Price Waterhouse & Co. LLP.

Published by HT Digital Content Services with permission from VC Circle.