New Delhi, Nov. 17 -- SIDBI Venture Capital Ltd (SVCL), a subsidiary of Small Industries Development Bank of India, the apex body to promote micro, small and medium enterprises in the country, has marked the first close of Antariksh Venture Capital Fund (AVCF) at Rs 1,005 crore (around $113.5 million).

The closure was anchored by a Rs 1,000 crore-commitment from Indian National Space Promotion and Authorisation Centre (IN-SPACe), it said. An autonomous agency that has been set up under the Department of Space, IN-SPACe helps, authorises and supervises private entities' participation in space-related activities.

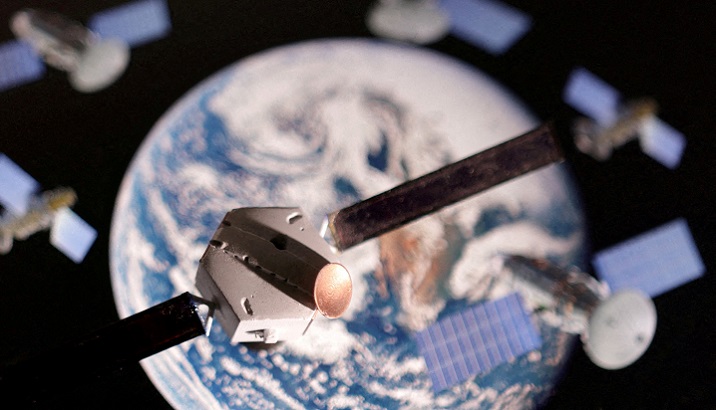

AVCF, registered as a Category II alternative investment fund, has target corpus of Rs 1,600 crore (around $181 million). It will invest across early and growth stages in Indian spacetech enterprises. The investments will be made across launch systems, satellites and payloads, in-space services, ground services, earth observation, communications and downstream applications.

The Indian government had proposed its plans to set up a space-focused venture capital fund in Budget 2024 in July. It aims to support the scaling up of operations and the commercialisation of new technologies, empowering the companies to contribute to India's broader space ambitions through the fund. It received approval in October 2024 for a $119 million fund.

SVCL will now mobilise additional commitments from domestic and international investors, including institutional and sovereign investors, under the green-shoe option.

"SVCL's journey dates to 1999 with the National Venture Fund for Software & IT Industry as its first VC fund. Over the years, SVCL-managed funds have backed category-defining companies, including unicorns like BillDesk and Data Patterns," said Arup Kumar, managing director and CEO, SVCL.

"The Antariksh Venture Capital Fund, India's largest spacetech-focused fund and among the largest globally, will play an instrumental role in advancing national space capability and competitiveness."

The development is in line with India's strategy to liberalise and commercialise the country's fledgling space sector, which has been historically controlled by the government. India opened the sector for private launches in 2020.

Last year, the country allowed 100% foreign direct investment (FDI) in manufacturing of satellite systems without any prior approval, as it aims to increase its share in the global space market.

Several startups in the space, including Agnikul and Skyroot, have received venture capital funding from domestic and global investors. The sector benefits from relatively lower cost of production in the country. The two startups have successfully launched homegrown private rockets in space since 2022.

Published by HT Digital Content Services with permission from VC Circle.