New Delhi, Aug. 11 -- Lavni Ventures, an early-stage technology-focused impact investor, has launched its second fund with a corpus of Rs 200 crore ($22.8 million) to invest in deep-tech startups in climate, healthcare, energy, and education.

The Bengaluru-based venture capital firm, which received SEBI registration last October for the Category-II vehicle, also announced the first close of the fund on Monday.

The new fund will bet on Indian deep-tech startups, deploying Rs 2-8 crore at the seed to Series A stage, and Rs 8-15 crore for follow-on investments, according to a statement.

The firm claims to review over 800 deep-tech deals annually, selecting those with sustainable business models, measurable impact, and exit potential.

With government-backed initiatives like the National Deep Tech Startup Policy and the Deep Tech Innovation Platform, the firm said it aims to "ride the wave of moment" with the second fund by investing in startups building tech-driven solutions to solve some of the world's "toughest" problems.

Through Fund I, Lavni has invested in sanitary pads recycling startup Padcare Labs, heart monitoring solutions provider Monitra Healthcare, and medical devices company MedPrime Technologies. Fund I was a discovery fund to validate Lavni's deep-tech impact thesis, a spokesperson told VCCircle, declining to share details.

"The successful launch of Fund II, with strong repeat participation from Fund I LPs, validates our core thesis: Indian deep-tech founders are uniquely positioned to deliver scalable impact and attractive returns," said Vasu Guruswamy, co-founder and general partner at Lavni Ventures.

"India's capital-efficient innovation models, depth of technical talent, and increasingly mature startup ecosystem make it one of the most compelling deep-tech investment markets globally," he added.

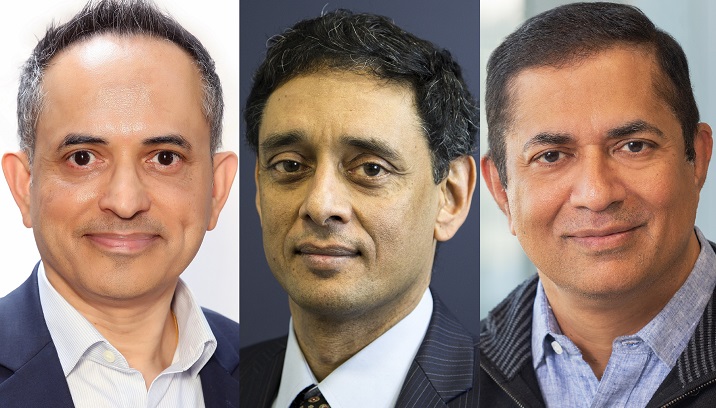

Founded in 2020 by Guruswamy, Sanjay Kanvinde, and Krishna Shivram, Lavni Ventures is a SEBI-registered Category-II alternative investment fund specializing in deep-tech impact investing. Lavni, which means "future" in Haitian Creole, has previously backed companies in medtech, edtech, cleantech, agritech, and energy.

Published by HT Digital Content Services with permission from VC Circle.