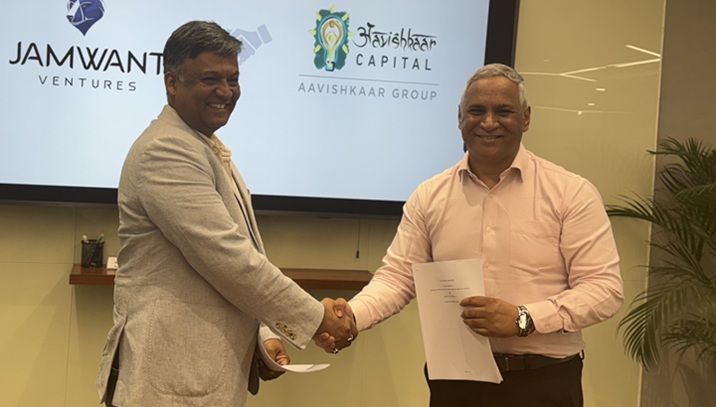

New Delhi, Oct. 9 -- Defence-focussed early-stage investor Jamwant Ventures has partnered with impact investment firm Aavishkaar Group to launch its second fund, targeting a corpus of Rs 500 crore, top executives told VCCircle.

The fund will have a greenshoe option of Rs 250 crore.

Jamwant Ventures Fund 2, a successor to the investor's debut fund, will be focused on defence and deep tech startups, said Navneet Kaushik, Founder, Jamwant Ventures.

"We will be focusing on the early stage and early-growth stage. Our initial cheque size will be between $1 to $4 million," he said. The fund will invest in about 18-20 companies.

On the partnership, Kaushik said, "We have the domain expertise, but we are still new fund managers. It's been only two years since we have come into the ecosystem.

"Also, the defence opportunity in India has (grown) suddenly, and there's a sense of urgency. Aavishkaar brings the infrastructure and understanding of the financial ecosystem, and when we combine together, our journey cuts down the time that is required."

The two firms are awaiting approval from capital markets regulator Securities and Exchange Board of India (SEBI) for the category II alternative investment fund.

Indian Navy Officers Kaushik and Kartik Gopal launched Jamwant's first fund last year and were joined by Jyotsana Dalal, who was formerly the technology project lead of Technology Development Board, under the Department of of Science and Technology.

Meanwhile, Aavishkaar Capital, through its offering 'OneAavishkaar' will help Jamwant Ventures in areas such as fundraising, treasury, governance, operations, ESG and compliance.

"OneAavishkaar is a platform that is looking to build the ecosystem by supporting, nurturing and helping emerging fund managers, by leveraging the infrastructure that we have built over the last two decades," said Tarun Mehta, Partner, Funds & Strategy, Aavishkaar Capital.

Going forward, Aavishkaar is aiming to partner with many more emerging managers in the country, particularly with sector-specialist funds to jointly launch funds through OneAavishkaar.

The latest partnership will involve Jamwant and Aavishkar both as co-general partners (GP). However, Jamwant is the controlling shareholder, while Aavishkaar is a minority shareholder.

"We will be raising capital. We will be launching the fund as co-GP and co-sponsors. But, Jamwant will be leading all the investment activity," said Mehta.

The fund will initially reach out to government institutions, insurance companies, banks and family offices in India to rope in as limited partners. Then, early next year, they will reach out to international investors, he said.

Jamvat's first fund, a category I fund, invested in six startups and ended up deploying nearly Rs 40 crore across pre-seed, seed and Series A startups. Its portfolio includes firms such as Spacefields, TIEA Connectors, Axial Aero, Aeronero among others.

"We are very bullish on autonomous systems, new materials, emerging materials, then probably will also be looking at quantum communication systems," he added.

Published by HT Digital Content Services with permission from VC Circle.