New Delhi, June 23 -- Emcure Pharmaceuticals Ltd, a Pune-based drugmaker that counts private equity firm Bain Capital as an investor, is buying the 20.42% stake it doesn't already own in Zuventus Healthcare Ltd for Rs 724.9 crore ($83.5 million).

Emcure, which currently owns 79.58% of Zuventus, said in a stock-exchange filing its board had approved the acquisition of the residual stake in its subsidiary from minority shareholders. The transaction is set to be completed by the second quarter of the current financial year, following which Zuventus will become a wholly owned subsidiary of Emcure.

"This transaction will enable full financial consolidation of Zuventus and drive long-term value creation for Emcure, through alignment across its domestic business and unlock synergies," Emcure said.

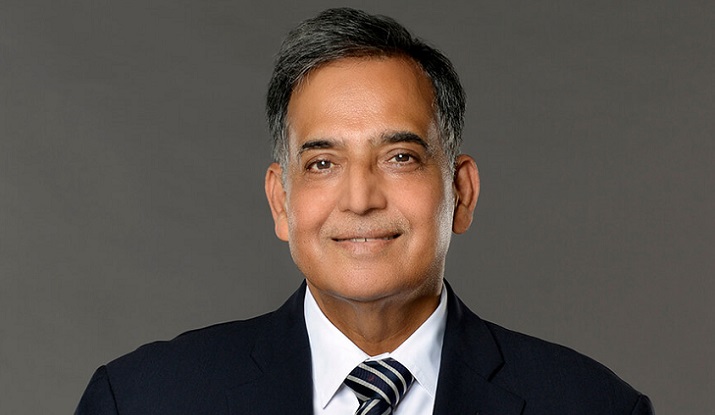

Zuventus was incorporated in 2002 as a joint venture among Prakash Kumar Guha, CV Shetty, S Balasubramaniam, and Emcure. Guha is managing director at Zuventus and its single-biggest individual shareholder. Apart from Guha, Shetty and Balasubramaniam, Emcure CEO and managing director Satish Mehta, director Sunil Mehta and some other individuals own shares of Zuventus, according to shareholding disclosures accessed by VCCircle.

Zuventus initially marketed Emcure's products but subsequently started selling its own products. Zuventus has manufacturing facilities in Jammu, Sikkim and Bengaluru. According to VCCEdge, the data research platform of VCCircle, Zuventus clocked revenue from operations of Rs 1,050 crore for FY24 and a net profit of Rs 124.91 crore.

The acquisition comes almost a year after Emcure had a strong listing on the stock exchanges with its stock jumping nearly 35% on listing day. Currently, however, the company's counter is trading around Rs 1,332 per share, which is at a slight discount to its debut price on the day it was listed.

Bain Capital first acquired a stake in Emcure in 2013, purchasing it from the Blackstone Group for Rs 700 crore. Bain held a 13% stake before Emcure went public last year. At present, the PE firm holds a 8.68% stake in the company. News reports recently said that Bain Capital was preparing for a full exit from the company.

Founded in 1981, Emcure focuses on areas such as gynecology where it has a market share of more than 14%, which makes it one of the leaders in this segment in India. Analysts say the HIV segment is likely to drive its future growth.

Published by HT Digital Content Services with permission from VC Circle.