Mumbai, April 16 -- Equity benchmark indices Sensex and Nifty closed higher for the third straight day on Wednesday following buying in banking stocks and fresh foreign fund inflows as retail inflation slipping to near six-year lows raised hopes of further rate cuts.

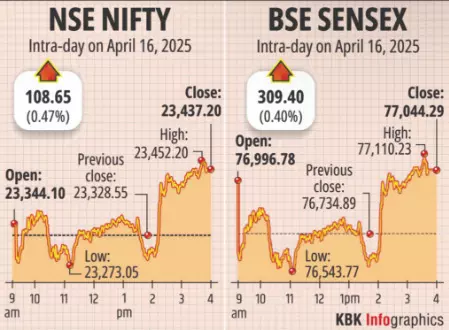

Defying a weak global market trend, the 30-share BSE Sensex climbed 309.40 points or 0.40 per cent to settle at a two-week high of 77,044.29 in a volatile session. After a weak start, the index moved between gains and losses during the session. It hit a high of 77,110.23 and a low of 76,543.77, gyrating 566.46 points.

The NSE Nifty rallied 108.65 points or 0.47 per cent to 23,437.20.

Positive macro data and forecast of normal monsoon boosted investor sentiment, analysts said.

IndusInd Bank rose the most by 7.12 per cent amonf Sensex shares. The bank stated that external agency PwC has assessed a negative impact of Rs 1,979 crore on the bank's networth due to accounting lapses in the derivatives portfolio.

Axis Bank jumped 4.26 per cent while Adani Ports rose by 1.81 per cent. Asian Paints, HDFC Bank, Bharti Airtel, State Bank of India and ITC were among the gainers.

Maruti was the biggest loser, falling by 1.51 per cent. Infosys, Tata Motors, Larsen & Toubro, NTPC and Bajaj Finance were among the laggards.

Foreign Institutional Investors (FIIs) turned buyers after days of selling as they bought equities worth Rs 6,065.78 crore on Tuesday, according to exchange data. "Globally, markets are undergoing fresh consolidation as tariff tensions intensify... Amidst global weakness, the Indian market exhibited a mild positive sentiment in anticipation that the trade fight between the US & China will not harm but benefit India, and March's CPI inflation which is at a nearly 6-year low is indicative of further rate cuts in the near future," Vinod Nair, Head of Research, Geojit Investments Limited, said.

Domestically, the Q4 FY25 earnings season has started on a weak note. Overall expectations remain subdued, suggesting potential profit booking at higher levels, Nair added.

The BSE smallcap gauge climbed 0.91 per cent and midcap index rallied 0.62 per cent.

Among BSE sectoral indices, oil & gas climbed the most by 1.78 per cent, followed by bankex (1.45 per cent), energy (1.25 per cent), telecommunication (1.08 per cent), financial services (1.07 per cent) and services (0.73 per cent).

IT, auto, capital goods and BSE Focused IT were the laggards.

As many as 2,636 stocks advanced while 1,309 declined and 133 remained unchanged on the BSE. "Participants responded positively to favourable cues, including the update on a normal monsoon, further easing of retail inflation, and, importantly, the absence of any negative surprises from global markets. Notably, the sustained strength in banking and financial stocks, along with rotational buying in other sectoral heavyweights, played a significant role in driving the momentum," Ajit Mishra - SVP, Research, Religare Broking Ltd said.

Gensol Engineering shares plunged 5 per cent, hitting the lower circuit after Sebi barred the company and its promoters over alleged fund diversion and governance lapses. Asian and European markets were mostly lower, though Shanghai ended higher.

Published by HT Digital Content Services with permission from Millennium Post.