Mumbai, June 9 -- Bharat Electronics Ltd (BEL) and Tata Electronics have signed a memorandum of understanding (MoU) to advance India's self-reliance in the electronics and semiconductor sectors. This partnership supports the government's vision of fostering indigenous technological solutions and marks a significant collaboration between the two companies.

The MoU was formalised on 5 June at the Tata Group's Mumbai headquarters by BEL chairman Manoj Jain and Tata Electronics CEO Dr Randhir Thakur.

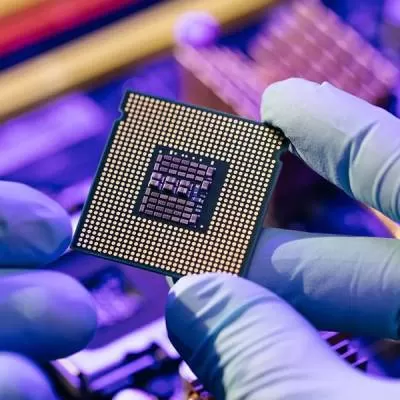

The alliance between state-owned BEL and Tata Electronics-a greenfield venture under the Tata Group-will concentrate on opportunities in semiconductor fabrication, outsourced semiconductor assembly and test (OSAT), and design services.

Tata Electronics will provide solutions to meet BEL's present and future needs, including components such as Microcontrollers (MCUs), Systems-on-Chip (SoCs) and Monolithic Microwave Integrated Circuits (MMICs). Both companies intend to combine their expertise to deliver optimal manufacturing outcomes.

This collaboration is a strategic step towards realising self-sufficiency in India's electronics and semiconductor capabilities. By emphasising indigenous technology development, BEL and Tata Electronics aim to transform the domestic market landscape.

The partnership reflects a commitment to innovation and excellence, supporting enhanced economic growth and technological progress in India's electronics industry.

Following the announcement after market hours on Friday, BEL shares closed 0.76 per cent lower at Rs 390.70. The stock traded above key moving averages, including the 5-day, 10-, 20-, 30-, 50-, 100-, 150-, and 200-day simple moving averages (SMAs). Its 14-day relative strength index (RSI) stood at 76.14, signalling an overbought condition (above 70).

BEL's stock has a price-to-earnings (P/E) ratio of 57.54 and a price-to-book (P/B) ratio of 16.42. Earnings per share (EPS) were recorded at 6.79, with a return on equity (RoE) of 28.55 per cent. According to Trendlyne data, the company has a one-year beta of 1.3, indicating relatively high stock volatility.

As of March 2025, promoters held a 51.14 per cent stake in BEL, the state-run defence electronics manufacturer.

Published by HT Digital Content Services with permission from Construction World.